Roth Ira Contribution Limits 2025 Annual Income. The ira contribution limit is $7,000 in 2025 ($8,000 if age 50. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025.

The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older. 2025 roth ira income limits.

The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

The IRS announced its Roth IRA limits for 2025 Personal, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. But there are income limits that restrict who can contribute.

The IRS just announced the 2025 401(k) and IRA contribution limits, You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re. The same combined contribution limit applies to all of your roth and traditional iras.

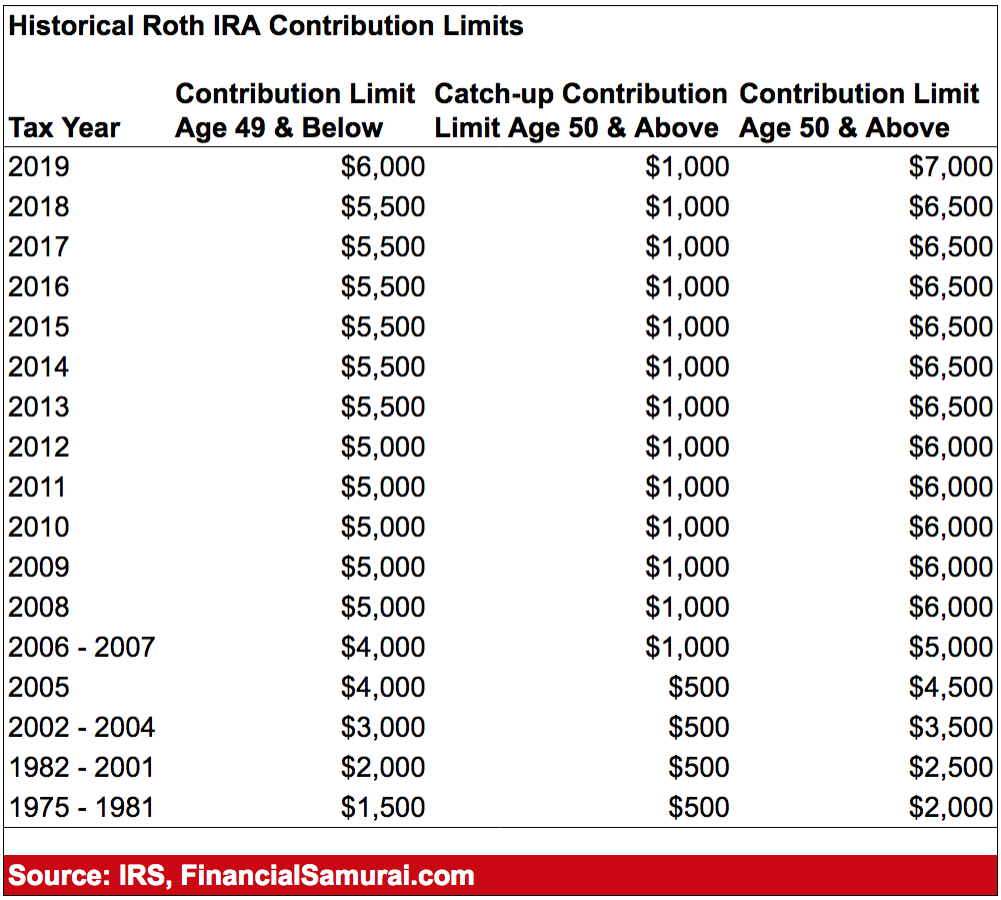

Why I Never Contributed To A Roth IRA But Why You Probably Should, The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. 2025 roth ira income limits.

Acp Limits For 2025 Addie Anstice, Limits on roth ira contributions based on modified agi. The roth ira income limits will increase in 2025.

Irs Limit 2025 Moll Teresa, Limits on roth ira contributions based on modified agi. In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira.

What Is The Ira Contribution Limit For 2025 2025 JWG, Your tax filing status also impacts how much you can contribute. For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025).

Tax Rules 2025 Retha Martguerita, The roth ira contribution limit is $7,000 in 2025. Limits on roth ira contributions based on modified agi.

Roth IRA vs. 401(k) A Side by Side Comparison, Just be sure that you contribute no more than the permissible limits for each account. 12 rows the maximum total annual contribution for all your iras combined is:

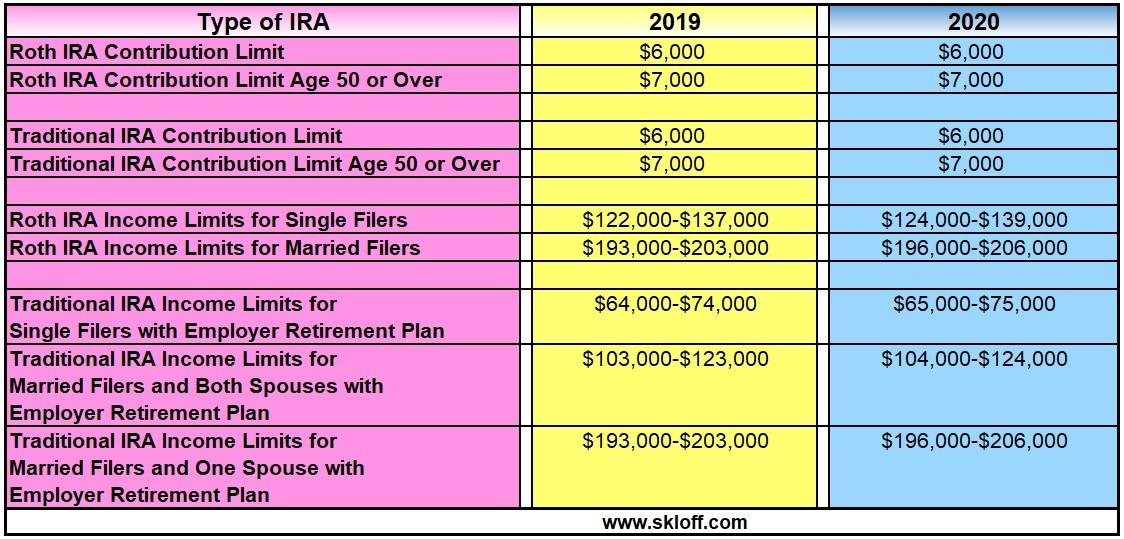

IRA Contribution and Limits for 2019 and 2025 Skloff Financial, For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025). You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

2025 Contribution Limits Announced by the IRS, For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025). You can add $1,000 to that amount if you're 50 or older.